What Are Altcoins?

Altcoins, a term derived from the combination of “alternative” and “coin,” refer to any cryptocurrency other than Bitcoin. Since Bitcoin’s emergence in 2009 as the first decentralized cryptocurrency, the digital currency landscape has expanded substantially with thousands of altcoins now available. These alternative coins encompass a diverse range of technologies, features, and purposes, thus playing a crucial role in the overall dynamics of the cryptocurrency market.

Altcoins can be categorized into several groups based on their use cases and underlying technology. For instance, some altcoins are designed to improve upon Bitcoin’s functionality by offering enhanced transaction speeds or lower fees, such as Litecoin or Bitcoin Cash. Others, such as Ethereum, introduce the concept of smart contracts—self-executing contracts with the terms of the agreement directly written into code. This innovation has opened doors for decentralized applications (dApps) and further advancements in blockchain technology.

The significance of altcoins extends beyond mere investment opportunities; they serve as vehicles for technological experimentation and adoption. Projects like Cardano and Polkadot aim to create scalable and interoperable blockchain systems, potentially reshaping how different coins and applications communicate. Furthermore, altcoins can provide investors with opportunities for diversification, as their values may not always correlate directly with Bitcoin’s performance, thereby minimizing overall portfolio risk.

In addition to innovation and investment potential, the rise of altcoins has also fostered community engagement and development efforts. Many altcoin projects encourage open-source collaboration, empowering individuals to contribute to the growth and improvement of these cryptocurrencies. Thus, understanding altcoins is essential for anyone looking to navigate the evolving world of digital currencies, as they represent both the challenges and innovations that define the future of finance.

How Do Altcoins Differ from Bitcoin?

Altcoins, or alternative coins, represent all cryptocurrencies other than Bitcoin. Established in the early 2010s, altcoins were developed to address various limitations observed in Bitcoin, such as transaction speed and energy efficiency. The origins of these coins often reflect different philosophies or technological advancements, resulting in a diverse ecosystem within the cryptocurrency landscape.

One significant difference between Bitcoin and altcoins lies in their technological infrastructure. Bitcoin employs a proof-of-work consensus mechanism, which, while secure, has been criticized for its high energy consumption and slower transaction times. In contrast, many altcoins utilize various consensus algorithms, such as proof-of-stake or delegated proof-of-stake, enhancing transaction speeds and reducing energy usage. For instance, Ethereum introduced smart contracts, enabling decentralized applications (dApps) to be built on its platform, a feature not natively available on Bitcoin.

Market capitalization further distinguishes Bitcoin from altcoins. Bitcoin remains the leading cryptocurrency by market cap, accounting for a substantial portion of the entire market. In contrast, individual altcoins tend to have smaller market caps, resulting in higher volatility. This volatility can present both risk and opportunity for investors looking to diversify their portfolios. The diverse purposes of altcoins also contribute to this distinction; many aim to provide specialized services or target niche markets, ranging from privacy-focused transactions to decentralized finance (DeFi) solutions.

Transaction speed is another critical differentiator. While Bitcoin’s average transaction confirmation time can fluctuate, many altcoins have been developed to ensure faster processing. For instance, coins like Ripple have a transaction speed of mere seconds, vastly outperforming Bitcoin’s average of around 10 minutes. This performance difference can be a decisive factor for users requiring immediate transactional capabilities.

Types of Altcoins

Altcoins, or alternative coins, encompass a diverse range of digital currencies that extend beyond Bitcoin. Understanding the various types can provide insight into their specific uses and roles in the cryptocurrency ecosystem. Primarily, these altcoins can be categorized into four significant types: utility tokens, security tokens, stablecoins, and meme coins.

Utility tokens are designed to serve a particular purpose within their respective ecosystems. These tokens enable holders to access a product or service, often functioning as a medium of exchange within a platform. For instance, Ethereum (ETH) is often used for transaction fees in decentralized applications on its blockchain. Another example is Binance Coin (BNB), which provides reductions in trading fees on the Binance exchange.

Security tokens, in contrast, represent investment contracts and are often linked to traditional assets, such as stocks or real estate. They are subject to regulatory scrutiny, as they are considered securities. An example is tZERO, which aims at providing blockchain-based trading for securities. These types of tokens offer a level of compliance and credibility to investors.

Stablecoins are designed to maintain a stable value by pegging themselves to a reserve asset, like the US dollar. This design makes stablecoins instrumental in providing a stable medium for transactions within the volatile cryptocurrency market. Examples include Tether (USDT) and USD Coin (USDC), both of which aim to minimize price fluctuations, thus enhancing usability in trading environments.

Lastly, meme coins have gained popularity primarily due to their cultural and social significance in the cryptocurrency community. Coins like Dogecoin (DOGE) exemplify how these digital currencies can capitalize on internet trends and community engagement, although they often lack fundamental utility. Each of these altcoin types plays a unique role in the expansive crypto landscape, reflecting the evolving nature of digital finance.

Investing in Altcoins: Pros and Cons

Investing in altcoins, which refer to any cryptocurrency other than Bitcoin, offers a plethora of opportunities and risks for potential investors. One of the primary advantages of investing in altcoins is the potential for higher returns. Many altcoins have shown remarkable price increases following their initial coin offerings (ICOs) or during market uptrends. By carefully selecting promising altcoins, investors could capitalize on substantial gains, far exceeding those typically associated with traditional assets.

Moreover, altcoins contribute to a well-diversified portfolio. With thousands of cryptocurrencies available, investors can spread their capital across various projects, reducing risk exposure to individual assets. This diversification can help mitigate the potential impacts generated by adverse movements in any single cryptocurrency, thus enhancing the overall stability of an investment portfolio.

However, investing in altcoins is not without its drawbacks. One major concern is the inherent volatility of these digital assets. Prices of altcoins can fluctuate dramatically over short periods, leading to significant financial losses for investors who may not be adequately prepared for such swings. Additionally, the relatively nascent nature of the altcoin market can create further uncertainty and risk.

Another potential disadvantage is the lack of regulation, as many altcoins are not subject to the same rigorous oversight as traditional financial markets. This absence of regulation can expose investors to fraud, scams, and projects with unclear intentions. Moreover, the lack of established frameworks may present challenges in ensuring compliance with existing financial laws.

In light of these factors, prospective investors should carefully weigh the benefits and risks associated with altcoin investments. Engaging in thorough research and analysis, as well as understanding one’s risk tolerance, is essential when navigating the altcoin market.

How to Choose the Right Altcoin

Selecting the appropriate altcoin for investment can be a challenging yet rewarding venture. With thousands of options available, it is vital to employ a strategic approach when making your choice. One of the first steps in this process is to research the underlying technology of a particular altcoin. Understanding the technological framework can provide insights into its potential and challenges. Look for coins that offer innovative features or improvements over existing blockchain technology, as these can indicate long-term viability.

Next, consider the use case of the altcoin. A strong coin should solve a real-world problem or meet a specific need in the market. Evaluate how the altcoin intends to create value and whether its proposed solution has a welcoming audience or community. This involves checking whitepapers and project documentation for detailed information on the altcoin’s objectives, practical applications, and market positioning.

The team behind the project is another crucial aspect to investigate. A reliable and experienced development team can significantly influence the success of an altcoin. Conduct a background check on the team members to assess their credentials and previous work in the cryptocurrency or blockchain sector. Networking and community engagement are equally important. Join forums, social media groups, or attend local meetups where discussions about various altcoins take place. Engaging with the community can provide valuable insights and perspectives that may not be easily accessible through traditional market analysis.

Lastly, staying updated on market trends is essential. Monitor price movements, trading volumes, and overall investor sentiment towards particular altcoins. Utilize analytics tools to track historical performance and gauge community interest. By following these strategies diligently, investors can make informed decisions when choosing the right altcoin for their portfolio, aligning with both their risk tolerance and investment goals.

How to Buy and Store Altcoins

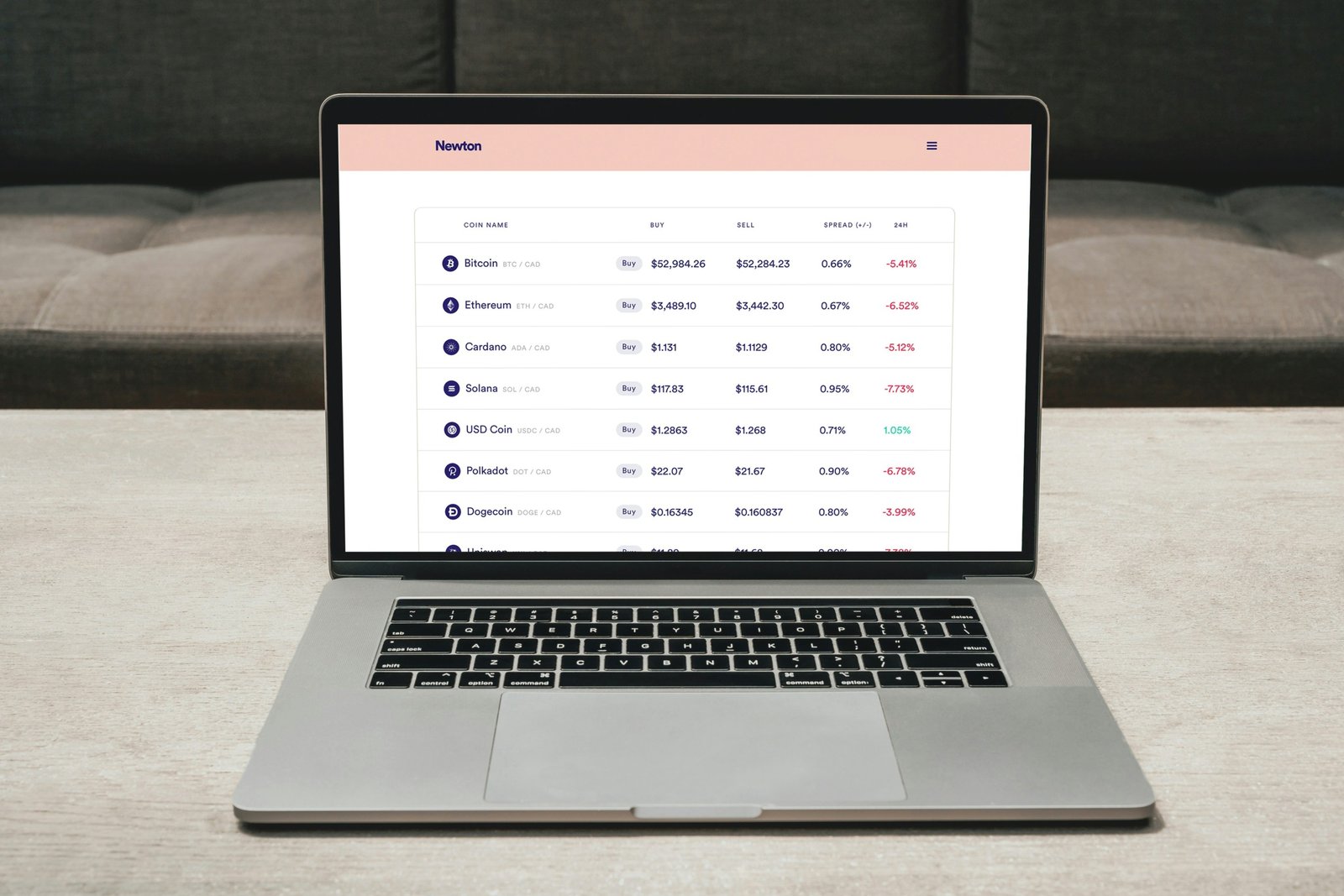

Investing in altcoins requires a systematic approach to purchasing and safeguarding these digital assets. The initial step involves selecting a reliable exchange where altcoins can be purchased. Popular exchanges such as Coinbase, Binance, and Kraken provide a broad selection of altcoins alongside user-friendly interfaces, making them suitable for both beginners and experienced investors. It is prudent to conduct thorough research on the exchange you choose, comparing factors such as fees, available trading pairs, and security measures.

Once you have established an account on your chosen exchange, the next step is to fund it. Most exchanges accept fiat currency deposits via bank transfers, credit cards, or other payment methods. After your account is funded, you can proceed to purchase your desired altcoins. It is advisable to start with smaller amounts if you are new to the cryptocurrency space, allowing you to familiarize yourself with the trading environment without exposing yourself to significant risk.

Following the acquisition of altcoins, it is crucial to store them securely to protect against potential theft or loss. This is where digital wallets come into play, which can be categorized into hot and cold wallets. Hot wallets, being connected to the internet, offer convenience for frequent trades but also pose higher risk due to their exposure to online threats. Conversely, cold wallets, such as hardware wallets and paper wallets, are offline, rendering them less vulnerable to cyber-attacks. For long-term storage and security, it is generally recommended that investors utilize cold wallets.

Implementing strong security practices is also essential. This includes enabling two-factor authentication (2FA) on your accounts, using complex passwords, and regularly updating them. Staying informed about the latest security threats in the cryptocurrency landscape will further aid in safeguarding your investment. By following these strategies for buying and storing altcoins, investors can work towards preserving their digital assets and maximizing their investment potential.

The Future of Altcoins

The altcoin market is poised for significant evolution as it navigates recent trends and technological advancements. One of the most critical factors influencing the future of altcoins is regulatory development. As governments and regulatory bodies worldwide continue to assess their approach to cryptocurrencies, new policies could either hinder or facilitate the growth of altcoins. This regulatory landscape has the potential to foster legitimacy within the altcoin market, attracting institutional investors who have previously hesitated to enter due to regulatory uncertainties. Additionally, frameworks that promote transparency and consumer protection may enhance public trust in altcoins.

Technological advancements also constitute a central pillar of altcoin evolution. As blockchain technology matures, we are likely to witness innovations that improve scalability, efficiency, and security within altcoin ecosystems. Projects employing innovative consensus mechanisms or leveraging functionalities such as smart contracts are expected to gain traction. The integration of decentralized finance (DeFi) applications with altcoins may further drive their use, leading to enhanced utility and real-world applicability.

Shifts in investor behavior will additionally play a pivotal role in shaping the altcoin landscape. The increasing participation of retail investors has led to heightened interest and market volatility in altcoins. Moreover, a growing awareness of diverse investment strategies—such as yield farming and staking—may encourage investors to diversify their portfolios further, moving beyond dominant cryptocurrencies like Bitcoin and Ethereum. Social sentiment, often amplified by online communities and platforms, will continue to influence the investment landscape of altcoins, driving engagement and speculative trading.

In conclusion, the future of altcoins appears dynamic, influenced by evolving regulations, technological advancements, and shifts in investor behavior. It remains to be seen how these factors will converge to define the next chapter of the altcoin market, but their impact is likely to be profound and lasting.

Common Misconceptions About Altcoins

Altcoins, or alternative cryptocurrencies, often face a myriad of misconceptions that can cloud a potential investor’s judgment. One prevalent misunderstanding is that altcoins are mere offshoots of Bitcoin, lacking legitimacy and intrinsic value. While it is true that Bitcoin is the first and most established cryptocurrency, many altcoins are designed with unique features and innovations that address specific issues within the blockchain ecosystem. For instance, Ethereum introduced smart contracts, significantly expanding the functionality and use cases for cryptocurrencies beyond mere transactions.

Another common myth is the belief that altcoins are simply destined to fail and replace Bitcoin eventually. While it is important to recognize that some altcoins may indeed fall short of their promises, many have shown resilience and growth, contributing positively to the crypto market. Altcoins can complement Bitcoin instead of merely competing with it; they provide options for investors with different needs and preferences. The success of a particular altcoin often hinges on its community, technology, and real-world application rather than a straightforward comparison to Bitcoin.

Furthermore, many individuals perceive altcoins as inherently riskier investments, leading to a general fear of engaging with them. Although the volatility of altcoins can be greater than that of Bitcoin, this does not necessarily equate to a lack of potential for growth or returns. Just like in any financial market, informed decision-making is crucial. Investors should conduct thorough research, examining the technology, market trends, and future prospects of altcoins before forming an opinion. By dispelling these misconceptions, potential investors can better navigate the world of altcoins and appreciate their value in the ever-evolving cryptocurrency landscape.

Conclusion: The Importance of Altcoins in Crypto Ecosystem

Throughout this blog post, we have explored the multifaceted role that altcoins play within the cryptocurrency ecosystem. Unlike Bitcoin, which is often seen as the flagship digital currency, altcoins represent a vast array of alternatives that serve distinct purposes and functionalities. These alternative coins not only contribute to the diversification of investment portfolios but also foster a dynamic environment for innovation. By offering various use cases, altcoins enable investors to engage with the cryptocurrency market in a more tailored manner, aligning with their individual financial goals and risk appetites.

One of the primary advantages of altcoins is their capacity to introduce new technologies and concepts to the blockchain landscape. For instance, some altcoins focus on enhancing transaction speed, while others aim to provide greater privacy or scalability solutions. This diversity not only enriches the market but also drives ongoing technological advancements, ultimately benefiting the broader cryptocurrency community. Investors often find that by including altcoins in their portfolios, they can mitigate risks associated with Bitcoin’s price volatility and capitalize on growth opportunities present in nascent technologies.

As we conclude our discussion, it is evident that altcoins hold significant relevance in the cryptocurrency universe. Their contributions to diversification and innovation underline the importance of understanding these alternative assets. To fully grasp the potential of altcoins, we encourage readers to further their education, exploring various projects beyond Bitcoin. By doing so, they can make informed decisions that align with their investment strategies and stay abreast of the rapidly evolving landscape of digital assets.